Property Management Outsourcing has different structures – each one leading to a different business model. Primarily, we’d see three models used in this industry – corporate, business, and functional.

The word “structure” is a broad term. But in this context, we’ll refer to structure as the responsibilities and reporting related to customer focus in real estate and property management.

Moreover, all organizational structures have pros and cons regarding transaction costs and the principal-agent complex. Thus, the business model is what we’ll focus on in this article as it better represents the sentiments of property managers.

In the business model, the focus is directly on outsourcing as a business strategy. Here, managers focus on value-creating resources and how it’s used within the firm.

Examples of value-creating resources are top managers, agents, and other integral employees that focus on driving profit into the businesses.

As such, management should decide if the value activity should be in-house or outsourced. Furthermore, the firm should determine if a value-creating resource available in-house should be considered a separate function (outsourced) or keep it as a task within the organization.

For this reason, firms outsource non-dollar-productive activities to property management virtual assistants. Examples of these are data-entry or tenant-related documentation or processes. Most of these tasks are simple in nature – as a result, third-party services can handle them with ease.

Outsourcing as a Business Strategy

An organization’s business model relies on its “strategic capacity“. Danish economist Birger Wernerfelt says “strategic capacity” is determined through service, marketing, delivery, and monitoring.

Moreover, within the context of “capacity“, we can view a company’s competitive advantage as its value-creating activities and their interrelation.

For example, a real estate manager (agent) may prioritize a new lease over a customer service meeting. Additionally, new leases reduce vacancies and increase rental income.

However, both activities are important. But, one can be considered as a value-creating activity while the other doesn’t directly serve that purpose. As a result, managers can easily outsource customer service-related activities.

Meanwhile, based on the structures of property management outsourcing, two arguments are primarily discussed. Peter Palm from the Department of Urban Studies, Malmo University, Sweden conducted a study on outsourcing and says these two arguments are “resourced-based view” and “transactional costs”.

What is a Resourced-Based View (RBV)?

According to the study, the resourced-based view states if certain tasks are not done within a firm’s core business, they should be outsourced. Meanwhile, the next argument, “transactional costs“, states services available on the market for a lower price with the same or better quality than in-house, you should turn to the market.

Thus, outsourcing strategies should consider balancing the skills of third-party services in relation to the cost. Still, both terms are closely connected with each other.

Economist Oliver E. Williamson characterized this link as organizations integrating specific assets (or competencies) that create value. Thus, specific value-adding features are defined as the company’s core business.

Through this, outsourcing stepped away from short-term cost-cutting means and focused on long-term strategic outsourcing. Currently, this trend of long-term outsourcing better reflects the organizational structure and business model.

What Are Transactional Costs?

All business or service agreements have transaction fees. These include contract formation, information retrieval, and service exchange participation. Thus, transaction costs are all costs associated with performing an activity.

Transaction costs include contracting and getting information. As the transaction can include opportunistic behavior, expenses connected with misunderstandings, disagreements, and anything else that interrupts the service delivery exchange are also transaction costs.

According to the study, transaction costs can be studied on three levels. First, we have the overall structure of the firm. This level examines operational parts and their relationships.

The second level focuses on how the organization is structured which functions should be undertaken within the corporation and why. Third, how human assets are organized in the company.

Themes Motivating Property Managers To Outsource

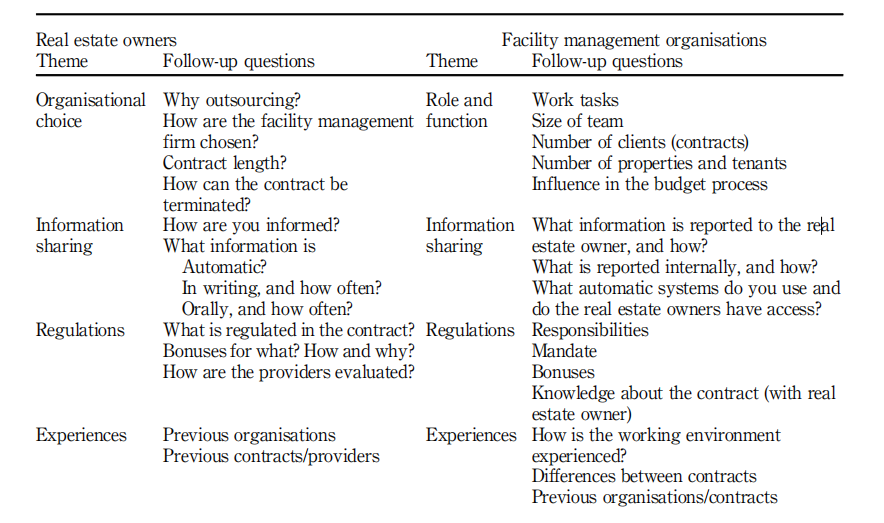

In the study, real estate owners answered interview questions based on four themes – Role and Function, Information Sharing, Regulations, and Experiences.

These became the basis or deciding factor for them to look into outsourcing. Shown below is the table and the result of the interview.

the property manager / Peter Palm

The primary theme that motivates real estate owners to outsource is divided into two parts – organizational choice and role and function. These themes focus on the work managers want to outsource, the size of the team they want to hire, and the current number of clients/properties they need to be managed.

Based on the table above, property managers should already have a baseline on what to consider when it comes to outsourcing. But, each organization would need specific strategies to make outsourcing work efficiently.

If you’re ready to start your outsourcing journey, Global Strategic can help with your business needs and give you the Strategic Advantage needed to edge out the competition. Talk to us today and learn more about how offshore outsourcing to the Philippines can help your business and future business growth.