How professional accounting services can strengthen community finances and board efficiency

Managing the finances of a homeowners association (HOA) can be a complex and time-consuming responsibility. Board members, who typically volunteer their time, may not have the financial expertise or available hours to handle all accounting tasks effectively. In the United States, approximately 30 percent of the population lives in community associations, with homes collectively valued at $12.2 trillion in 2023. This highlights the importance of maintaining sound financial management to protect significant investments and ensure the smooth operation of these communities.

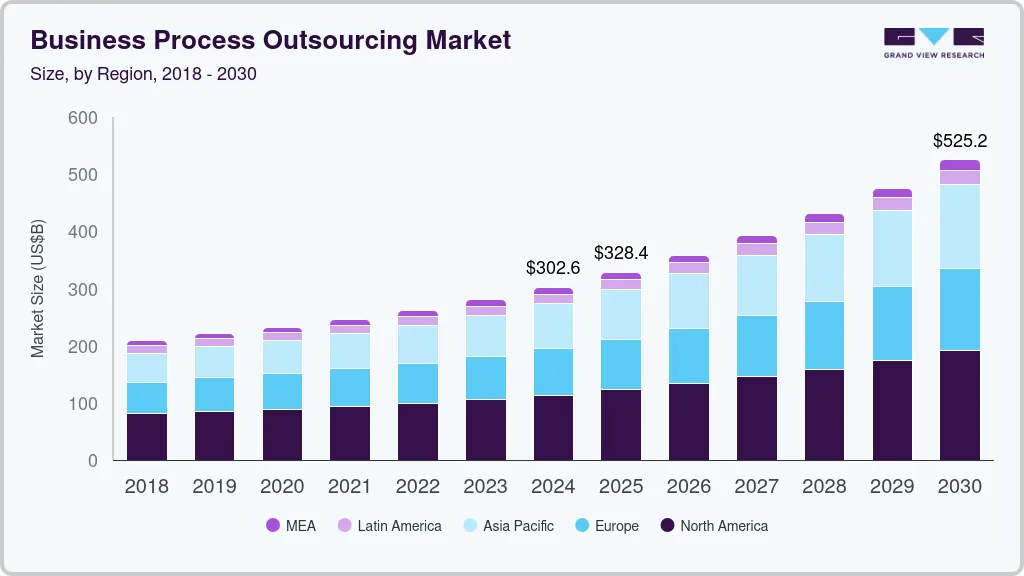

Outsourcing financial management to professional firms is an increasingly popular solution that can help associations maintain accurate records, streamline operations, and safeguard financial stability.

Advantages of Outsourcing HOA Financial Management

Professional Expertise and Guidance

Experienced financial management firms bring specialized knowledge tailored to HOAs. They understand industry standards, legal requirements, and fiscal best practices, helping boards navigate complex financial matters. Outsourced professionals can handle tasks such as assessment collections, accounts payable, financial reporting, and long-term budgeting. Their guidance allows boards to make informed decisions and respond efficiently to potential challenges.

For context, there are roughly 7,000 to 9,000 large-scale associations with more than 1,000 homes and annual budgets over $2 million. Managing finances in these communities can be highly complex, making professional expertise particularly valuable.

Advanced Technology and Security

Reputable firms use the latest accounting software and online tools, including automated payment systems, secure data storage, and reliable backups. This access often exceeds what a self-managed association can provide. By leveraging modern technology, boards can enhance operational efficiency, protect sensitive financial data, and improve payment convenience for residents.

In 2023, U.S. community associations collected $108.8 billion in assessments, funding essential obligations such as professional management services, insurance, utilities, security, common area maintenance, landscaping, capital improvement projects, and amenities like pools and clubhouses. Proper management of these funds is critical for maintaining high-quality services.

Time Savings and Reliable Service

Outsourcing frees board members to focus on broader community initiatives while ensuring financial tasks are completed accurately and on schedule. There are an estimated 2.5 million elected and appointed community association board and committee members contributing over 100 million volunteer hours annually. Professional firms help reduce this burden, allowing volunteers to focus on governance and strategic decisions rather than day-to-day accounting tasks.

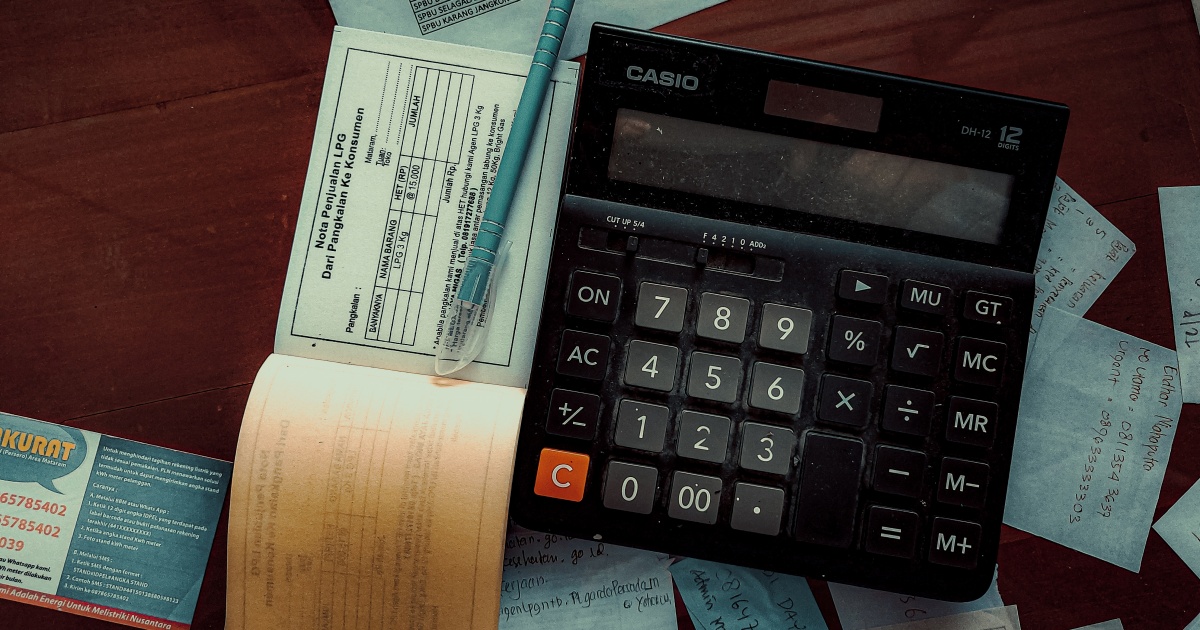

Cost Efficiency

Hiring in-house accountants or bookkeepers can be costly when considering salaries, benefits, training, and payroll taxes. Outsourcing allows HOAs to pay only for the services they need, often resulting in significant long-term savings. For example, the estimated value of volunteer time provided by board and committee members is $3.2 billion, demonstrating the economic impact of skilled, professional support that allows volunteers to focus on value-added work.

Improved Communication and Flexibility

Modern technology facilitates clear and responsive communication with outsourced professionals. Video calls, email, and collaborative platforms allow boards to stay connected, ensuring transparency and timely updates. Outsourced firms are also equipped to handle urgent issues, providing flexible support whenever necessary.

Scalability and Adaptability

As communities grow or financial transactions become more complex, outsourced firms can adjust their services to match evolving needs. This scalability allows HOAs to maintain high-quality financial management without hiring additional staff or investing in new software systems. Between 2014 and 2024, the number of HOA associations increased by 10.6%, and populations grew 15.6%, highlighting the need for adaptable financial solutions.

Considerations Before Outsourcing

While outsourcing offers clear benefits, associations should carefully weigh the costs, potential loss of direct control, and dependency on external providers. Selecting a reputable firm with proven experience, clearly defined services, and strong communication practices is essential to ensuring a successful partnership.

Making the Right Choice

Outsourcing HOA financial management can improve accuracy, efficiency, and strategic planning, while reducing risks associated with fraud or mismanagement. For boards facing time constraints or lacking financial expertise, it provides professional guidance and technological resources that would be difficult to replicate in-house.

With HOA homes on average priced 4 percent higher than comparable non-HOA homes, annual assessments contributing $108.8 billion, and collective property values reaching $12.2 trillion, professional, reliable financial management has never been more important. By carefully evaluating providers and establishing clear expectations, HOAs can make a strategic decision that safeguards their community’s financial health and supports long-term success.